Biography

I am a graduate student of Computer Science at Boston University and a full-stack developer with interests in software development, system architecture, and distributed system.

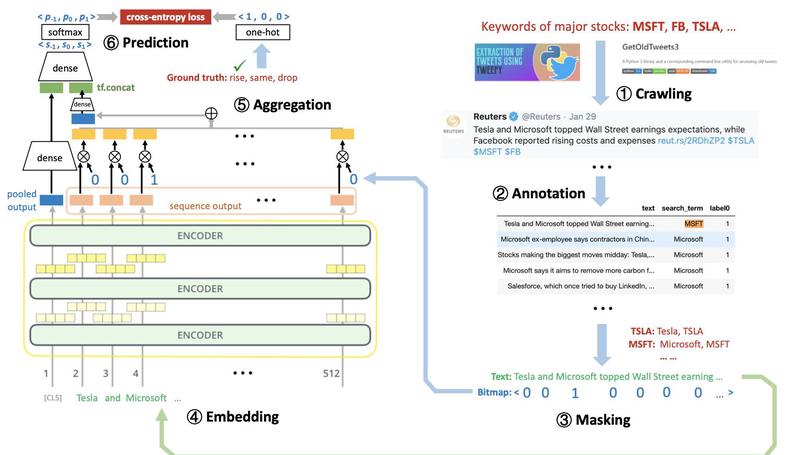

In October 2020, I published my academic paper BELT: A Pipeline for Stock Price Prediction Using News (IEEE Big Data 2020, first author).

In November 2020, I interned at KuaiShou Technology Co. as a data analyst.

In April 2022, I worked as a software development engineer intern at OPPO.

Now, I am a software development engineer intern at Yahoo.

My motto: Death is more universal than life; everyone dies but not everyone lives.

Three as most important in being a successful student: (1) self-motivation, (2) perseverance, and (3) focus.

Download my resumé.

- Full stack development

- System architecture

- Distributed system

MSc in Computer Science, 2024

Boston University

BSc in Fintech, 2021

Northeastern University(China)

Internship

Responsibilities include:

- Worked on the Anti-Abuse team for HTTP traffic protection against malicious users using C++ and Lua.

- Migrated our product to cloud by Kubernetes on AWS Elastic Kubernetes Service, reducing 20% latency.

- Applied Java, Python, and wrk2 to add multi-AZ performance and failover test suites to SafeT-AWS test bed.

- Refactored a distributed hash table component for multi-AZ AWS deployment, cutting costs over 50%.

- Utilized Screwdriver to build CI/CD pipelines, enhancing web application firewall and rate limiter efficiencies.

Responsibilities include:

- Created a face detection software module and integrated it into CV SDK using C++, which was used 800+ times.

- Applied MNN and SNPE engines to deploy models on CPU and DSP chips on the ARM architecture.

- Tested the performance of CV models on the mobile side by leveraging Android Debug Bridge (ADB).

- Developed tools with custom model quantization and operator introduction functions by C++ and Flatbuffers.

- Built a functional software module that can fuse multiple TFLite Graphs, reducing 60% message transfer time.

Responsibilities include:

- Set up a department data center from 0 to 1; drove and led the data reform and innovation.

- Utilized SQL to retrieve data from Hive table and completed over 1,500 SQL queries.

- Devised a visual data dashboard and a departmental data warehouse, decreasing data-querying time by 70%.

- Upgraded analytics tools by adding sensitive video title capture function using Python, serving over 2,000 users.

Projects

BU-On-The-Go: An Integrated On-Campus Mobile App

We developed an integrated on-campus mobile app called bu-on-the-go, which includes features such as Comprehensive Scheduling, Task Prioritization, Campus Map Navigation, Class Engagement System, Study Group Collaboration, and Chat Room functionality.

Tech Stack: Kotlin, Jetpack Compose, Python, Flask, MySQL

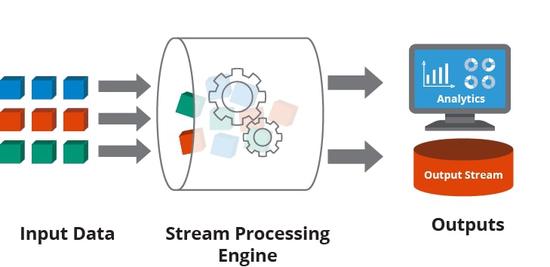

A Stream Processing System with State Disaggregation

We’ve created a cutting-edge prototype for a disaggregated data stream processing system using a standalone control plane, allowing task-state separation. The control plane serves as a routing table for state access, enabling seamless job reconfiguration without causing any downtime or disruption.

Tech Stack: Java, gRPC, RocksDB, Etcd, Docker Compose, Prometheus, Grafana

Posts

Featured Publications

Abstract—Stock investment is a vehicle for many people to grow their wealth. However, market downturns can cause huge losses and need to be predicted for a timely sell. In fact, with effective prediction, stocks are a good investment even during periods of market volatility as many stocks are “on sale”. News is an important source of signal for stock price movement. However, stock analysts usually adjust their analysis according to the news in a subject manner, and wrong judgments can cause investors huge losses. Twitter is a great source for breaking news, and provides a timely stream of signals on stock trends. News on Twitter also tends to have a great impact on the market due to the large number of Twitter users. This paper proposes a data-driven pipeline to timely incorporate Twitter news about a company into a time series prediction model on the company’s stock price. Our approach, called BERT-LSTM (BELT), extracts informative features on stock price direction from Twitter news using the state-of-the-art natural language processing (NLP) model BERT, which are then used as covariates to a many-to-many stacked LSTM model that also utilizes historical stock prices to predict the direction of future stock price. Utilizing a carefully curated stock news dataset, we fine-tune BERT to effectively identify those news tweets that are relevant, and to extract NLP features that are indicative of price rises and falls. All model parameters are trained end-to-end to provide a data-driven and objective pipeline to incorporate news signals so as to avoid subjective analysis. Extensive experiments on real stock prices and Twitter news show that BELT is able to predict stock prices more accurately utilizing news information than if historical price data are used alone for prediction, and beats StockNet which is the current state of the art for news-based stock movement prediction. Index Terms—stock, news, prediction, BERT, LSTM

Contact

- neudongyingzhe@gmail.com

- +1 8573135836

- 53 Quint Ave, Boston, MA 02134

- Everyday 10:00 to 23:00

- Book an appointment

- DM Me